The dawn of Artificial Intelligence (AI) and embedded finance is revolutionizing consumer lending, offering unparalleled efficiency, personalization, and accessibility. As financial institutions grapple with evolving market conditions and heightened consumer expectations, the urgency to adapt has never been more critical.

Currently, the global consumer credit market is poised to ascend to an impressive $13.5 billion by 2025, while the burgeoning embedded finance sector is projected to skyrocket to a staggering $7.2 trillion by 2030. These figures underscore an undeniable shift in the lending landscape, with AI technologies facilitating a potential reduction in loan processing times by up to 70%, thereby enhancing customer satisfaction.

Furthermore, the AI-driven credit scoring market is set to expand to $7 billion by 2027, promising more accurate risk assessments and broader access to credit for consumers. As the popularity of alternative financing options like Buy-Now-Pay-Later (BNPL) continues to rise, financial institutions must recognize that the time to innovate and overhaul their lending strategies is now. By embracing AI and embedded finance, they can not only meet the demand for personalized lending experiences but also ensure their continued relevance and success in a rapidly changing environment.

In light of the rapid expansion of AI-driven solutions within embedded finance, industry experts emphasize the necessity for a strategic overhaul within financial institutions. A prominent voice in this discussion noted, ‘The time is now for financial institutions to rethink their innovation strategies; collaboration will define the organizations that do not get disintermediated.’ This perspective aligns seamlessly with the growing trend of integrating AI into decision-making processes. As organizations embrace collaboration and innovation, they position themselves to adapt in a market that demands responsive and personalized lending solutions, ensuring they remain relevant and resilient.

Industry experts underscore the importance of innovation strategies and AI’s role in lending. Here are key insights from industry leaders:

- Radha Suvarna states, “Banks are looking to invest for growth. BaaS and embedded finance is an area where they see opportunities to grow and to reach new audiences cost-effectively through indirect channels.”

Source - Ryan O’Holleran emphasizes, “Embedded finance has the capacity to be a catalyst for future innovation and growth for businesses worldwide. By seamlessly incorporating financial services into various digital platforms, it allows for a more interconnected and efficient market landscape that can meet endless customer needs.”

Source - Tariq Bin Hendi notes, “Looking ahead, AI is set to play a transformative role in embedded finance by enabling real-time processing of payments and transactions, enhancing security and providing hyper-personalized financial services.”

Source - John Piazza remarks, “Businesses’ expectations have fundamentally changed: Operators want banking at the point of need, and increasingly that is in their enterprise resource planning software, point-of-sale platforms or other tailored workflow systems.”

Source - Adena Friedman envisions AI’s critical role across various financial aspects, stating that “AI could save financial advisers between 10 to 15 hours per week by automating tasks such as transcribing client meeting notes and tailoring investment discussions.”

Source

These quotes illustrate a shared understanding among industry leaders about the necessary evolution in innovation strategies to leverage AI within consumer lending, ultimately aiming to meet growing consumer expectations and enhance operational efficiencies.

As the embedded finance landscape evolves, key industry quotes shed light on future trends in consumer lending, emphasizing the importance of collaboration and innovation. One expert poignantly stated, “The time is now for financial institutions to rethink their innovation strategies; collaboration will define the organizations that do not get disintermediated.” This sentiment echoes the urgent need for financial institutions to innovate in a competitive market driven by consumer expectations and technological advancement.

Key Insights from Industry Experts

- Radha Suvarna, who stresses the growth potential in embedded finance, explains, “Banks are looking to invest for growth. BaaS and embedded finance is an area where they see opportunities to grow and to reach new audiences cost-effectively through indirect channels.” This highlights an ongoing trend where banks seek innovative avenues to connect with consumers while expanding their reach.

- Ryan O’Holleran notes the transformative power of embedded finance, stating, “Embedded finance has the capacity to be a catalyst for future innovation and growth for businesses worldwide.” His insights underline a critical intersection of technology and finance, indicating that seamless integration of financial solutions can drive market efficiency and meet diverse customer needs.

- Tariq Bin Hendi emphasizes AI’s role in enhancing the embedded finance ecosystem, asserting, “Looking ahead, AI is set to play a transformative role in embedded finance by enabling real-time processing of payments and transactions, enhancing security and providing hyper-personalized financial services.” His forecast not only speaks to AI’s current applications but its potential to revolutionize service delivery in consumer lending.

- John Piazza calls attention to changing consumer expectations, stating, “Businesses’ expectations have fundamentally changed: Operators want banking at the point of need, and increasingly that is in their enterprise resource planning software, point-of-sale platforms or other tailored workflow systems.” This reinforces the demand for flexibility and immediate access to financial services in contemporary business operations.

- Adena Friedman recognizes the value of automation in finance, sharing her perspective that “AI could save financial advisers between 10 to 15 hours per week by automating tasks such as transcribing client meeting notes and tailoring investment discussions.” This statement reflects the broad impact of AI beyond lending, illustrating its potential to enhance operational efficiency across financial sectors.

Implications for the Future

These quotes collectively reflect a consensus within the industry that the future of consumer lending hinges on embracing technology and innovation. Collaboration among financial institutions, technologists, and consumers will be pivotal in reshaping the lending landscape, ensuring personalized, efficient, and inclusive financial services. As the demand for AI-driven solutions increases, institutions that prioritize adaptability and collaborative strategies are poised to thrive in the emerging embedded finance ecosystem.

Market Trends in AI-Enabled Embedded Finance

The merger of artificial intelligence (AI) and embedded finance is driving significant changes in consumer lending, unveiling key market trends that promise to reshape the industry.

Growth Projections

The embedded finance market is anticipated to soar to $7.2 trillion by 2030, propelled by the growing integration of financial services and digital platforms. This growth reflects a broader shift in how individuals and businesses seek financing through embedded solutions. Currently, consumer lending is experiencing a compound annual growth rate (CAGR) of 4.14%, indicating a strong potential for growth in line with the advancement of AI technologies.

AI Integration in Consumer Lending

AI technologies are revolutionizing consumer lending by enhancing decision-making, lowering risks, and customizing consumer experiences. By utilizing data analytics, AI is fostering more precise credit scoring models that expand lending to underserved groups. For example, AI platforms can evaluate creditworthiness using non-traditional metrics, enabling lenders to provide products to those without standard credit histories.

Rise of Buy-Now-Pay-Later Models

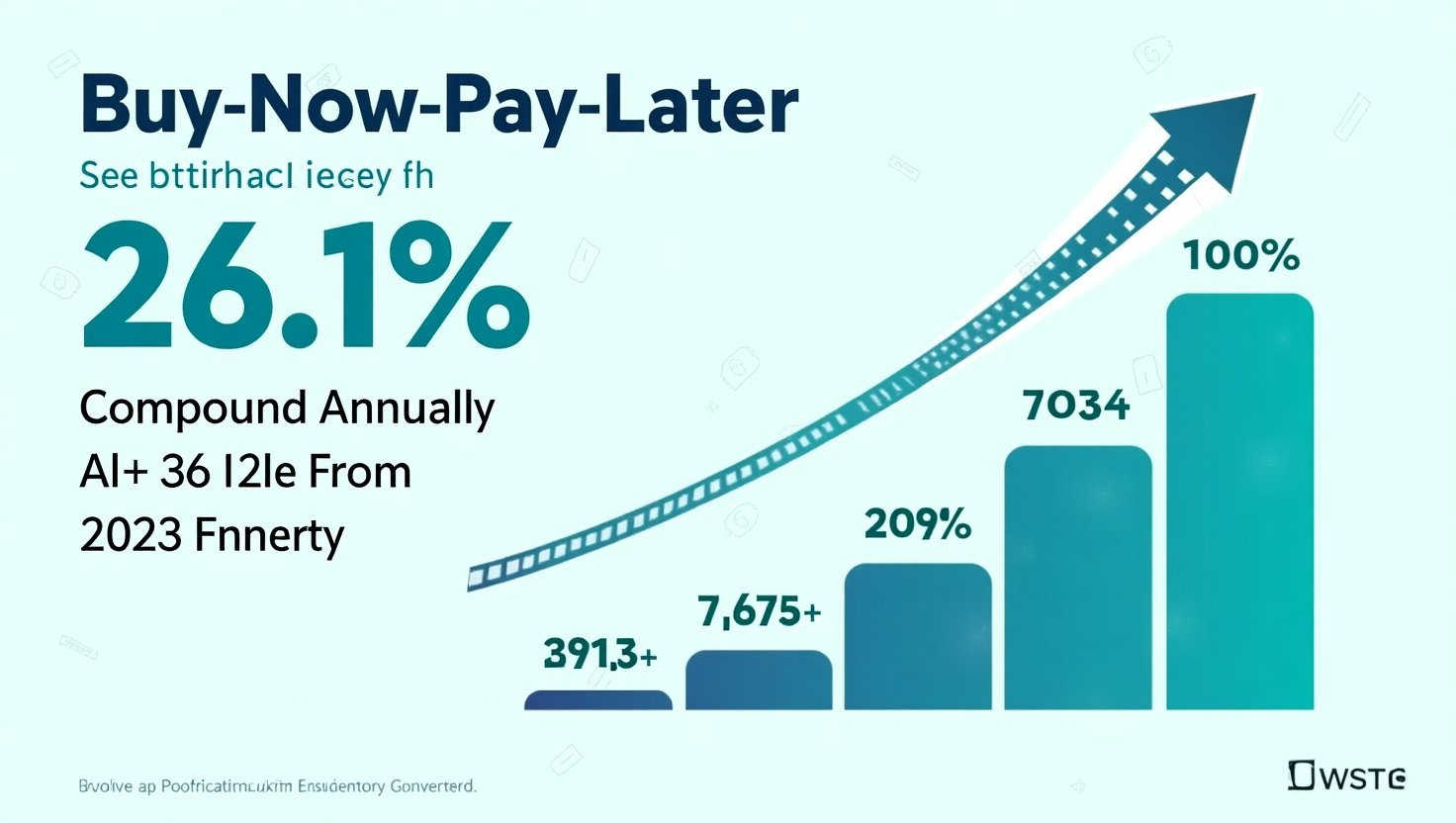

The rise of Buy-Now-Pay-Later (BNPL) services highlights shifting trends in consumer lending. As flexible payment options gain popularity, BNPL is projected to grow at an impressive CAGR of 26.1% from 2023 to 2030. This trend caters to the rising consumer need for adaptable payment solutions and promotes financial inclusion by offering more affordable credit choices.

Regional Growth and Market Size

North America is a dominant force in the embedded finance market, with a projected market size of $31.2 billion in 2024. Concurrently, the Asia Pacific region is expected to be the fastest-growing market, showcasing a projected CAGR of 34.2% from 2025 to 2033. The rapid adoption of digital financial services and supportive regulatory frameworks are driving this growth.

Enhancements in Fraud Detection and Personalized Lending

AI-driven fraud detection mechanisms are essential for ensuring security in consumer transactions. These systems can cut false positives by up to 50%, effectively enhancing the identification of fraudulent actions. Furthermore, AI’s data analytics capabilities empower lenders to create personalized lending solutions that meet specific consumer needs and preferences, becoming crucial in a competitive lending landscape.

Conclusion

Overall, the trends driving AI-enabled embedded finance in consumer lending indicate a significant shift toward more inclusive, flexible, and personalized financial services. As the embedded finance market expands, it carries substantial implications for consumer lending, illustrating the need for innovation and agility in today’s financial environment.

| Region | Projected Market Size (2024) | CAGR (%) (2025-2033) |

|---|---|---|

| North America | $31.2 billion | 10.5% |

| Asia Pacific | $18.5 billion | 34.2% |

| Europe | $13.1 billion | 15.1% |

| Latin America | $8.4 billion | 12.8% |

| Middle East & Africa | $6.1 billion | 16.3% |

AI Integration in Consumer Lending

Artificial Intelligence (AI) is increasingly transforming consumer lending by enhancing decision-making processes, improving credit scoring models, and promoting financial inclusion.

Statistics on AI Integration in Consumer Lending:

- Loan Approvals and Default Rates: AI applications have increased loan approval rates by up to 25% and reduced default rates by 15% across multiple financial institutions. Source

- Operational Efficiency: The adoption of AI in underwriting has reduced approval times from days to hours for 78% of lenders. Source

- Customer Engagement: AI-driven personalization in consumer lending has led to a 40% increase in customer engagement. Source

- Financial Inclusion: AI algorithms have increased approval rates for minority applicants by 20%, helping reduce lending disparities. Source

Notable Case Studies:

- Upstart: This lending platform utilizes AI to assess credit risk by incorporating factors such as education, employment history, and work experience. This approach has enabled Upstart to approve 27% more applicants than traditional methods while achieving 40% lower loss rates. Source

- M-Shwari (Kenya): Developed by Commercial Bank of Africa and Safaricom, M-Shwari uses AI to analyze mobile money transactions, offering instant microloans to users without traditional credit histories. This initiative has significantly expanded financial inclusion in Kenya, providing loans to rural and low-income individuals previously excluded from formal financial services. Source

- Paytm (India): Paytm implemented an AI-driven credit scoring system that leverages e-commerce transactions and digital wallet usage data. This model assesses creditworthiness based on real-time purchasing behavior and spending patterns, enabling the extension of small loans to gig economy workers and small businesses, thereby bridging the credit gap for individuals outside the formal banking system. Source

Performance Enhancements Due to AI:

- Risk Assessment: AI models have improved default prediction accuracy by 18%, allowing lenders to better assess and mitigate potential risks. Source

- Fraud Detection: The implementation of AI in fraud detection systems has decreased false-positive rates by 25%, leading to fewer unnecessary loan rejections and enhancing the overall customer experience. Source

- Operational Costs: Lenders utilizing AI report a 35% reduction in operational costs related to loan processing, highlighting the efficiency gains from AI integration. Source

These examples and statistics underscore the transformative impact of AI in consumer lending, demonstrating its potential to enhance decision-making, improve credit scoring accuracy, and promote greater financial inclusion.

AI Integration in Consumer Lending

The financial landscape is undergoing a radical transformation through the integration of Artificial Intelligence (AI) in consumer lending. This technology is enabling financial institutions to unlock unprecedented efficiencies and elevate the customer experience, ultimately reshaping how loans are approved and managed.

Increased Loan Approvals and Enhanced Efficiency

AI’s ability to analyze vast amounts of data quickly and accurately is directly influencing loan approval rates. According to industry data, financial institutions using AI have witnessed a remarkable 25% increase in loan approvals. More importantly, this increased access extends to previously marginalized communities, with AI-driven algorithms increasing approval rates for minority applicants by 20%. On the efficiency front, AI has slashed the average loan approval time from several days to just a few hours for around 78% of lenders, marking a significant leap forward in operational speed.

Cost Savings and Improved Decision-Making

Integrating AI into the consumer lending process not only speeds up approvals but also enhances overall decision-making capabilities. Traditional methods of credit scoring often rely on rigid metrics, whereas AI evaluates a broader spectrum of data, leading to more nuanced risk assessments. Reports indicate that AI-enhanced decision-making has improved default prediction accuracy by 18%, effectively reducing default rates by 15% across many financial institutions. Furthermore, lenders incorporating AI have reported a 35% reduction in operational costs related to loan processing, highlighting AI’s role in optimizing resources.

Case Studies of AI Platforms in Lending

Several platforms exemplify how AI is revolutionizing consumer lending:

- Upstart Holdings Inc. leverages AI to assess credit risk by considering non-traditional data points such as education and job history. This innovative approach has enabled Upstart to approve 27% more applicants than traditional methods, while achieving loss rates 40% lower than industry averages. This repositioning of credit assessment reflects a fundamental shift toward a more inclusive model of lending.

- M-Shwari in Kenya, a collaboration between Commercial Bank of Africa and Safaricom, uses AI to analyze mobile money transactions and provide instant microloans. This service extends credit to individuals with no formal credit histories, radically improving financial inclusion in regions where traditional banking services are scarce.

- Paytm, an Indian digital payments platform, implements an AI-driven credit scoring model that assesses users based on e-commerce activity, enabling loans to gig economy workers who might otherwise struggle to qualify for financing.

These case studies underline the tangible benefits AI brings to consumer lending, demonstrating how it fosters broader access to finance while mitigating risks.

Conclusion

The future of consumer lending is undeniably intertwined with AI technology. By harnessing advanced analytics and machine learning capabilities, lenders are not only enhancing their operational efficiencies but are also creating a more equitable financial landscape. As financial institutions continue to integrate AI into their practices, they position themselves to meet the evolving demands of consumers, ensuring a seamless and inclusive lending experience. Thus, the ongoing evolution of AI in consumer lending stands as a testament to the potential of technology to transform industries and empower individuals.

In conclusion, the intersection of artificial intelligence and embedded finance is redefining the landscape of consumer lending, paving the way for significant advancements in how financial services are delivered. As financial institutions navigate this rapidly evolving environment, it is crucial for them to embrace innovation and adaptability to meet changing consumer demands. The trends highlighted in this article demonstrate that AI is not just a tool for operational efficiency; it is a catalyst for personalized, inclusive lending that extends access to a broader demographic.

With the embedded finance market projected to reach an immense $7.2 trillion by 2030, there is a compelling impetus for financial institutions to prioritize AI-driven solutions. The anticipated growth in the consumer credit market further reinforces the need for organizations to rethink their innovation strategies and collaborate effectively. As these trends materialize, it is essential for institutions to remain vigilant and responsive, leveraging data and analytics to enhance decision-making processes and reduce risks.

Looking ahead, the implications for financial institutions are profound. Success in the consumer lending space will hinge on the ability to adapt and thrive within this new technological framework, ensuring that all consumers have access to the financial products they need, when they need them. The future of lending is indeed bright, and those who choose to lead through collaboration and technological integration will set the standard for success in the years to come.

In conclusion, the intersection of artificial intelligence and embedded finance is redefining the landscape of consumer lending, paving the way for significant advancements in how financial services are delivered. As financial institutions navigate this rapidly evolving environment, it is crucial for them to embrace innovation and adaptability to meet changing consumer demands. The trends highlighted in this article demonstrate that AI is not just a tool for operational efficiency; it is a catalyst for personalized, inclusive lending that extends access to a broader demographic.

With the embedded finance market projected to reach an immense $7.2 trillion by 2030, there is a compelling impetus for financial institutions to prioritize AI-driven solutions. The anticipated growth in the consumer credit market further reinforces the need for organizations to rethink their innovation strategies and collaborate effectively. As these trends materialize, it is essential for institutions to remain vigilant and responsive, leveraging data and analytics to enhance decision-making processes and reduce risks.

Looking ahead, the implications for financial institutions are profound. Success in the consumer lending space will hinge on the ability to adapt and thrive within this new technological framework, ensuring that all consumers have access to the financial products they need, when they need them. The future of lending is indeed bright, and those who choose to lead through collaboration and technological integration will set the standard for success in the years to come.

User Adoption of AI-Driven Embedded Finance Products in Consumer Lending

Recent data reveals a transformative shift in the consumer lending sector with the rising adoption of AI-driven embedded finance products. Here are key statistics and case studies that illustrate these trends:

Adoption Statistics

- Loan Approvals and Default Rates: AI applications have increased loan approval rates by up to 25% while reducing default rates by 15% across several financial institutions source.

- Customer Engagement: Utilization of AI-driven personalization has resulted in a 40% boost in customer engagement source.

- Operational Efficiency: The onboarding process for customers has been streamlined, with speeds improved by 60% due to AI-enhanced processes source.

- Widespread Adoption: As of 2023, around 55% of banking institutions have integrated AI into their lending processes source.

- Consumer Preference: About 65% of consumers express a preference for lenders using AI for quicker loan decision processes source.

Notable Case Studies

- Upstart Holdings Inc.: This platform leverages AI for credit underwriting, assessing a range of data beyond traditional metrics leading to a 27% increase in approvals and 40% lower loss rates source.

- Commonwealth Bank of Australia: Embedded generative AI features have cut customer scam losses by 50% and decreased fraud cases by 30%, while enhancing customer service efficiency source.

- Capital One: Their AI assistant Eno has halved call center contact volumes by addressing basic inquiries, providing alerts for unusual charges, and improving customer service efficiency source.

These statistics and case studies underscore the significant impact of AI on consumer lending, demonstrating increased operational efficiency, improved customer satisfaction, and enhanced financial inclusion.

SEO Optimization Suggestions for the Article on Embedded Finance in Consumer Lending

To optimize your article for search engines and enhance its visibility, here are several strategies to consider:

- Main Keyword Usage: Ensure the primary keyword embedded finance in consumer lending appears in critical locations:

- Title: Confirm it is included.

- Introduction: Position it within the first 100 words.

- Subheadings: Incorporate in at least one subheading.

- Conclusion: Reinforce its importance in the closing section.

- Related Keywords Integration: Naturally integrate related keywords throughout the content:

- AI-driven decisioning: Mention in the context of how AI improves lending processes.

- Credit assessment: Use when discussing evaluation techniques in consumer lending.

- Digital credit products: Reference in relation to new lending models.

- Alternative lending models: Discuss in the context of evolving options in consumer finance.

- Buy-Now-Pay-Later (BNPL): Highlight as a significant trend in the lending landscape.

- Financial institutions: Use whenever discussing the role of banks and lenders in adopting these technologies.

- Personalisation: Refer to how embedded finance allows for tailored borrowing experiences.

- Customer-centric lending: Discuss as a modern approach facilitated by technology.

- Decision-making: Highlight improvements in decision-making fostered by AI.

- Financial services: Use to discuss the broader implications of trends in lending.

- Automated lending: Incorporate while explaining efficiency gains from technology.

- Content Structure: Consider breaking up large paragraphs for better readability, using bullet points or lists where appropriate. This will improve user engagement and cater to SEO rankings.

- External Links: Link to authoritative sources for claims, such as statistics and case studies mentioned, which will increase trustworthiness and relevance.

- Internal Links: Incorporate internal links to other related articles or sections within your website to enhance user navigation and SEO.

By strategically including these keywords and following the above recommendations, the article can achieve better search visibility and reach a broader audience interested in embedded finance in consumer lending.