The revolution of stablecoins and artificial intelligence (AI) is transforming the landscape of cross-border commerce in Asia, offering powerful new opportunities for businesses eager to innovate and expand. In a region known for its dynamic entrepreneurial spirit, a remarkable 73% of enterprises across Singapore, India, China, and Japan are optimistic about reaching new customers internationally within the next year. This surge in business confidence is not just a hopeful statistic; it reflects a broader trend of adaptability and foresight amid an evolving digital economy.

Central to this transformation is Stripe, a leader in payment processing, which is at the forefront of introducing stablecoins and AI solutions to streamline transactions and foster international growth. With 46% of cross-border businesses anticipating growth in their international sales within the year, it is evident that these advancements are more than just technological trends—they are reshaping the future of global trade. As Stripe continues to process stablecoin payments from over 120 countries, the potential for efficiency and competitiveness in e-commerce is clearer than ever, calling for businesses to embrace this wave of change and seize the moment for expansive growth.

Current Market Confidence in Cross-Border Commerce

The atmosphere surrounding cross-border commerce in Asia is characterized by a robust market confidence brewing across various enterprises. As emerging technologies such as stablecoins and artificial intelligence (AI) alter the landscape, businesses are poised for growth.

Remarkably, 46% of cross-border businesses in the region expect a surge in their international sales within a year. This showcases a strong optimistic trend that is hard to ignore.

The words of Sarita Singh, the regional head of Stripe for Southeast Asia, India, and Greater China, articulate this confidence:

“Asia is showing extraordinary resilience and focusing on international growth.”

Singh’s insights mirror the market enthusiasm as businesses strategize to leverage advancements in technology for facilitating smoother and more efficient transactions.

Furthermore, 73% of enterprises from key markets such as Singapore, India, China, and Japan express readiness to reach new customers internationally within the next twelve months. This enthusiasm signals a broader commitment from the Asian business community to engage on a global scale, capitalizing on innovations like Stripe’s promotion of stablecoins and AI-driven solutions.

As Asian companies continue to embrace these technological shifts, it becomes increasingly clear that they are not just participating in the global market. They are also contributing to a new consumer confidence established by efficiency and reliability in their operations. The forecast for sales growth reflects a strategic pivot toward enhancing international trade capabilities, ensuring that cross-border commerce remains vibrant and resilient in times of change.

This prevailing optimism paints a hopeful picture for entrepreneurs and businesses alike, encouraging them to tap into the evolving landscape of cross-border trade with renewed confidence and tailored strategies for success.

Moreover, insights from leaders in the financial sector highlight the growing importance of stablecoins in cross-border trade. Zhao Changpeng (CZ), CEO of Binance, noted stablecoins globalize currencies and provide essential tools for international transactions (AsianFin). Additionally, Evan Auyang, Group President of Animoca Brands, emphasized Hong Kong’s vital role in facilitating stablecoins, asserting that they streamline cross-border trade and payments (Tatler Asia).

In summary, the prevailing business confidence in Asia supported by advancements in technology and endorsements from industry leaders underscores a vibrant future for cross-border commerce, all driven by the adoption of stablecoins and AI.

| Metric | Percentage or Value |

|---|---|

| Businesses confident in reaching new international customers | 73% |

| Expectation of international sales growth | 46% of cross-border businesses |

| Stripe users that sold internationally | 54% of Stripe’s users in Asia between July 2024 and June 2025 |

| Countries where Stripe processes stablecoin payments | Over 120 countries |

| Metric | Percentage or Value |

|---|---|

| Businesses confident in reaching new international customers | 73% |

| Expectation of international sales growth | 46% of cross-border businesses |

| Stripe users that sold internationally | 54% of Stripe’s users in Asia between July 2024 and June 2025 |

| Countries where Stripe processes stablecoin payments | Over 120 countries |

| Metric | Percentage or Value |

|---|---|

| Businesses confident in reaching new international customers | 73% |

| Expectation of international sales growth | 46% of cross-border businesses |

| Stripe users that sold internationally | 54% of Stripe’s users in Asia between July 2024 and June 2025 |

| Countries where Stripe processes stablecoin payments | Over 120 countries |

AI’s Role in Enhancing Cross-Border Commerce

Artificial Intelligence (AI), combined with blockchain technology, is significantly transforming cross-border commerce by enhancing transaction security and operational efficiency. Stripe, a leading fintech company, exemplifies this transformation through its AI-driven solutions like Stripe Radar.

AI’s Role in Cross-Border Commerce

AI technologies streamline various aspects of international trade by:

- Fraud Detection and Prevention: AI systems analyze vast datasets to identify and mitigate fraudulent activities, ensuring secure transactions across borders. The integration of blockchain adds an additional layer of security. This combination reinforces trust between buyers and sellers around the globe, allowing for smoother commerce.

- Customs Compliance and Risk Management: AI enhances compliance by analyzing trade data in real-time, identifying potential issues, and facilitating efficient customs processes. Incorporating blockchain can further enhance these processes, expediting the overall transaction flow and ensuring traceability.

- Logistics Optimization: AI predicts optimal shipping routes and manages inventory dynamically, reducing costs and improving delivery times. By allowing for the use of digital currencies, this leads to better customer satisfaction and lower abandonment rates in cross-border transactions.

Stripe Radar: Enhancing Transaction Security and Efficiency

Stripe Radar is an AI-powered fraud detection tool integrated into Stripe’s payment processing platform. It leverages machine learning trained on data from millions of global companies to identify and block fraudulent transactions in real-time.

Key features of Stripe Radar include:

- Real-Time Fraud Detection: Utilizes AI algorithms to assess the risk of fraud for each transaction, assigning risk scores and automatically blocking high-risk payments. This feature drastically reduces potential losses for businesses involved in cross-border trade.

- Customizable Rules Engine: Allows businesses to create and implement fraud prevention rules tailored to their specific needs, enhancing security measures. This flexibility empowers businesses to adapt to evolving scam strategies.

- Integration with 3D Secure: Incorporates additional authentication for high-risk card transactions, adding an extra layer of security. This further fortifies the trust required in cross-border transactions, ensuring that both sellers and buyers are satisfied with the security measures in place.

By integrating AI-driven tools like Stripe Radar, along with blockchain technology, businesses can significantly enhance transaction security and operational efficiency in cross-border commerce, fostering trust and facilitating smoother international trade.

Stripe’s Innovations Supporting Stablecoin Payments and AI

Stripe continues to set the standard in the payment processing landscape through cutting-edge innovations that cater specifically to the evolving needs of businesses navigating the stablecoin ecosystem and harnessing artificial intelligence (AI). Among its notable advancements are the Stripe Reader S710 and Stablecoin Financial Accounts, both designed to enhance transaction efficiency and enrich user experiences across the board.

Stripe Reader S710: The Future of Payment Processing

The Stripe Reader S710 is a state-of-the-art payment device that enables businesses to seamlessly accept a variety of payment methods, including stablecoins. Designed for versatility, it is perfect for both in-store and online purchases, ensuring that businesses can cater to a diverse customer base. This all-in-one card reader not only facilitates secure and speedy transactions but also integrates robust features such as contactless payments, allowing customers the flexibility to complete transactions with ease.

Companies utilizing the S710 can expect reduced wait times, thus enhancing customer satisfaction and encouraging more completed sales. Its compatibility with Stripe’s comprehensive platform further allows businesses to manage their finances and track performance in real time, enabling informed decision-making.

Stablecoin Financial Accounts: Innovating Financial Services

In tandem with the S710, Stripe’s Stablecoin Financial Accounts offer businesses a unique opportunity to leverage stablecoins for everyday transactions. These accounts are designed to simplify the flow of capital, enabling fast and low-cost transfers. As businesses increasingly gravitate towards cryptocurrencies, Stripe ensures that they can tap into the potential of stablecoins without the added complexities traditionally associated with digital currencies. This not only enhances liquidity but also helps stabilize value, providing businesses with a reliable means to manage their funds across borders without the usual volatility.

Empowering Businesses with Innovative Technology

The innovations presented by Stripe, particularly the Stripe Reader S710 and Stablecoin Financial Accounts, epitomize the company’s commitment to driving operational efficiency and empowering businesses. By reducing friction in payment processing and offering access to advanced financial tools, Stripe is fostering an environment where entrepreneurship can flourish. Businesses can confidently engage in cross-border transactions knowing that they have the support of world-class technology that prioritizes security and user experience. As a forward-thinking solution provider, Stripe is more than just a payment processor; it is a transformative partner in navigating the future of commerce with stablecoins and AI.

In summary, Stripe’s continuous innovations not only streamline transaction processes but also position businesses to seize new opportunities in the stablecoin marketplace. With a robust product lineup tailored to meet the demands of modern commerce, Stripe is paving the way for sustainable growth and success for businesses of all sizes in the Asia region and beyond.

Stripe’s Innovations Supporting Stablecoin Payments and AI

Stripe continues to set the standard in the payment processing landscape through cutting-edge innovations that cater specifically to the evolving needs of businesses navigating the stablecoin ecosystem and harnessing artificial intelligence (AI). Among its notable advancements are the Stripe Reader S710 and Stablecoin Financial Accounts, both designed to enhance transaction efficiency and enrich user experiences across the board.

Stripe Reader S710: The Future of Payment Processing

The Stripe Reader S710 is a state-of-the-art payment device that enables businesses to seamlessly accept a variety of payment methods, including stablecoins. Designed for versatility, it is perfect for both in-store and online purchases, ensuring that businesses can cater to a diverse customer base. This all-in-one card reader not only facilitates secure and speedy transactions but also integrates robust features such as contactless payments, allowing customers the flexibility to complete transactions with ease.

Companies utilizing the S710 can expect reduced wait times, thus enhancing customer satisfaction and encouraging more completed sales. Its compatibility with Stripe’s comprehensive platform further allows businesses to manage their finances and track performance in real time, enabling informed decision-making.

Stablecoin Financial Accounts: Innovating Financial Services

In tandem with the S710, Stripe’s Stablecoin Financial Accounts offer businesses a unique opportunity to leverage stablecoins for everyday transactions. These accounts are designed to simplify the flow of capital, enabling fast and low-cost transfers. As businesses increasingly gravitate towards cryptocurrencies, Stripe ensures that they can tap into the potential of stablecoins without the added complexities traditionally associated with digital currencies. This not only enhances liquidity but also helps stabilize value, providing businesses with a reliable means to manage their funds across borders without the usual volatility.

Empowering Businesses with Innovative Technology

The innovations presented by Stripe, particularly the Stripe Reader S710 and Stablecoin Financial Accounts, epitomize the company’s commitment to driving operational efficiency and empowering businesses. By reducing friction in payment processing and offering access to advanced financial tools, Stripe is fostering an environment where entrepreneurship can flourish. Businesses can confidently engage in cross-border transactions knowing that they have the support of world-class technology that prioritizes security and user experience. As a forward-thinking solution provider, Stripe is more than just a payment processor; it is a transformative partner in navigating the future of commerce with stablecoins and AI.

In summary, Stripe’s continuous innovations not only streamline transaction processes but also position businesses to seize new opportunities in the stablecoin marketplace. With a robust product lineup tailored to meet the demands of modern commerce, Stripe is paving the way for sustainable growth and success for businesses of all sizes in the Asia region and beyond.

Stripe’s Innovations Supporting Stablecoin Payments and AI

Stripe continues to set the standard in the payment processing landscape through cutting-edge innovations that cater specifically to the evolving needs of businesses navigating the stablecoin ecosystem and harnessing artificial intelligence (AI). Among its notable advancements are the Stripe Reader S710 and Stablecoin Financial Accounts, both designed to enhance transaction efficiency and enrich user experiences across the board.

Stripe Reader S710: The Future of Payment Processing

The Stripe Reader S710 is a state-of-the-art payment device that enables businesses to seamlessly accept a variety of payment methods, including stablecoins. Designed for versatility, it is perfect for both in-store and online purchases, ensuring that businesses can cater to a diverse customer base. This all-in-one card reader not only facilitates secure and speedy transactions but also integrates robust features such as contactless payments, allowing customers the flexibility to complete transactions with ease.

Companies utilizing the S710 can expect reduced wait times, thus enhancing customer satisfaction and encouraging more completed sales. Its compatibility with Stripe’s comprehensive platform further allows businesses to manage their finances and track performance in real time, enabling informed decision-making.

Stablecoin Financial Accounts: Innovating Financial Services

In tandem with the S710, Stripe’s Stablecoin Financial Accounts offer businesses a unique opportunity to leverage stablecoins for everyday transactions. These accounts are designed to simplify the flow of capital, enabling fast and low-cost transfers. As businesses increasingly gravitate towards cryptocurrencies, Stripe ensures that they can tap into the potential of stablecoins without the added complexities traditionally associated with digital currencies. This not only enhances liquidity but also helps stabilize value, providing businesses with a reliable means to manage their funds across borders without the usual volatility.

Empowering Businesses with Innovative Technology

The innovations presented by Stripe, particularly the Stripe Reader S710 and Stablecoin Financial Accounts, epitomize the company’s commitment to driving operational efficiency and empowering businesses. By reducing friction in payment processing and offering access to advanced financial tools, Stripe is fostering an environment where entrepreneurship can flourish. Businesses can confidently engage in cross-border transactions knowing that they have the support of world-class technology that prioritizes security and user experience. As a forward-thinking solution provider, Stripe is more than just a payment processor; it is a transformative partner in navigating the future of commerce with stablecoins and AI.

In summary, Stripe’s continuous innovations not only streamline transaction processes but also position businesses to seize new opportunities in the stablecoin marketplace. With a robust product lineup tailored to meet the demands of modern commerce, Stripe is paving the way for sustainable growth and success for businesses of all sizes in the Asia region and beyond.

In conclusion, the fusion of stablecoins and artificial intelligence (AI) is unlocking remarkable opportunities for businesses engaged in cross-border commerce in Asia. The statistics speak volumes: with 73% of enterprises in key Asian markets expressing confidence in their ability to reach new international customers within a year, the potential for growth is palpable. As seen with Stripe’s initiatives, businesses can leverage these innovations to enhance transaction efficiency, increase security, and ultimately expand their competitive edge in the global market.

AI is not merely a tool; it serves as a pivotal force driving operational excellence and fostering trust in cross-border transactions. The successful implementation of AI-driven solutions allows businesses to optimize their logistics, streamline compliance, and enhance customer experiences, thereby transforming challenges into opportunities.

The call to action for businesses is clear: embrace the transformations that stablecoins and AI offer. By investing in these technologies, companies can adapt to the rapidly changing landscape, tapping into the enthusiasm of 46% of cross-border businesses expecting an uptick in international sales. The path forward is bright, and with the right strategies in place, the horizon of cross-border commerce is set to expand like never before.

As entrepreneurs and enterprises across Asia navigate this dynamic environment, the time is now to harness the power of stablecoins and AI. The opportunities are immense and the transformative potential of these technologies can lead to unprecedented growth—so let’s seize the moment and unlock the future of commerce together.

In conclusion, the fusion of stablecoins and artificial intelligence (AI) is unlocking remarkable opportunities for businesses engaged in cross-border commerce in Asia. The statistics speak volumes: with 73% of enterprises in key Asian markets expressing confidence in their ability to reach new international customers within a year, the potential for growth is palpable. As seen with Stripe’s initiatives, businesses can leverage these innovations to enhance transaction efficiency, increase security, and ultimately expand their competitive edge in the global market.

AI is not merely a tool; it serves as a pivotal force driving operational excellence and fostering trust in cross-border transactions. The successful implementation of AI-driven solutions allows businesses to optimize their logistics, streamline compliance, and enhance customer experiences, thereby transforming challenges into opportunities.

The call to action for businesses is clear: embrace the transformations that stablecoins and AI offer. By investing in these technologies, companies can adapt to the rapidly changing landscape, tapping into the enthusiasm of 46% of cross-border businesses expecting an uptick in international sales. The path forward is bright, and with the right strategies in place, the horizon of cross-border commerce is set to expand like never before.

As entrepreneurs and enterprises across Asia navigate this dynamic environment, the time is now to harness the power of stablecoins and AI. The opportunities are immense and the transformative potential of these technologies can lead to unprecedented growth—so let’s seize the moment and unlock the future of commerce together.

In conclusion, the fusion of stablecoins and artificial intelligence (AI) is unlocking remarkable opportunities for businesses engaged in cross-border commerce in Asia. The statistics speak volumes: with 73% of enterprises in key Asian markets expressing confidence in their ability to reach new international customers within a year, the potential for growth is palpable. As seen with Stripe’s initiatives, businesses can leverage these innovations to enhance transaction efficiency, increase security, and ultimately expand their competitive edge in the global market.

AI is not merely a tool; it serves as a pivotal force driving operational excellence and fostering trust in cross-border transactions. The successful implementation of AI-driven solutions allows businesses to optimize their logistics, streamline compliance, and enhance customer experiences, thereby transforming challenges into opportunities.

The call to action for businesses is clear: embrace the transformations that stablecoins and AI offer. By investing in these technologies, companies can adapt to the rapidly changing landscape, tapping into the enthusiasm of 46% of cross-border businesses expecting an uptick in international sales. The path forward is bright, and with the right strategies in place, the horizon of cross-border commerce is set to expand like never before.

As entrepreneurs and enterprises across Asia navigate this dynamic environment, the time is now to harness the power of stablecoins and AI. The opportunities are immense and the transformative potential of these technologies can lead to unprecedented growth—so let’s seize the moment and unlock the future of commerce together.

User Adoption of Stablecoins in Asia

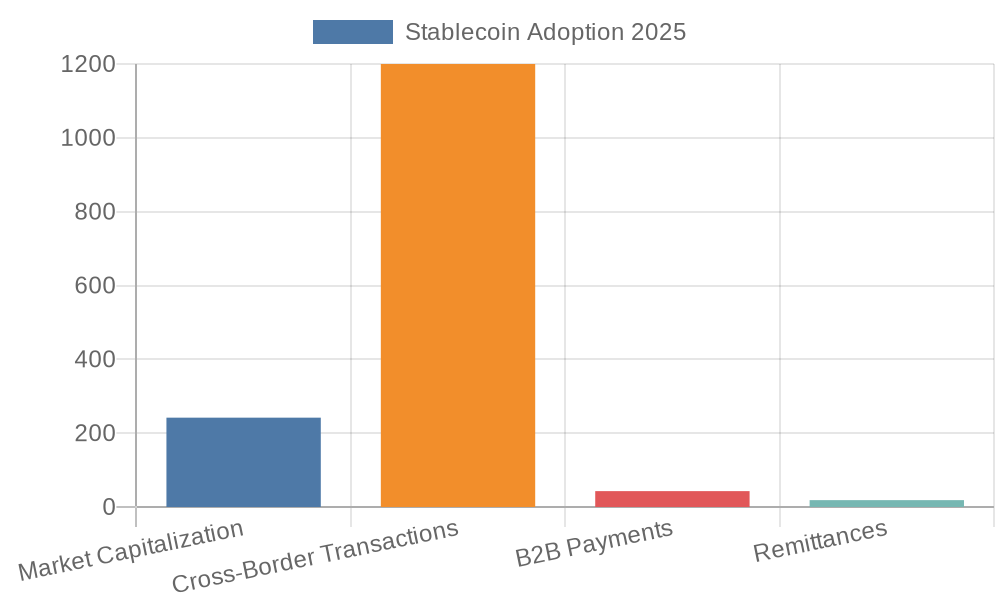

Recent statistics reveal a remarkable growth trajectory for stablecoins across Asia, underscoring their pivotal role in enhancing cross-border commerce. Notably, 56% of financial institutions in the region are already utilizing stablecoins, with an additional 40% planning to adopt them soon [Fireblocks]. This enthusiasm reflects a broader trend where stablecoins are increasingly seen as viable solutions for facilitating international transactions.

In terms of transaction volumes, Q2 2025 saw non-USD stablecoins in Southeast Asia average 258,000 transactions, predominantly driven by coins pegged to the Singapore Dollar, which comprised 70.1% of this volume. Meanwhile, 43% of B2B cross-border payments within the region are now processed using stablecoins, highlighting their capacity to provide faster and more cost-effective alternatives to traditional payment methods [ChainCatcher].

The stablecoin market has also reached new heights, boasting a remarkable $252 billion market capitalization by mid-2025. Among these, decentralized options like DAI and FRAX accounted for 20% of the market, illustrating both diversity and adoption in stablecoin varieties [CoinLaw].

Moreover, regulatory developments, including Hong Kong’s recent passing of the Stablecoins Bill, indicate a supportive environment for further growth [Kapronasia].

In summary, the data reflects a substantial and rapidly growing adoption of stablecoins among institutions and businesses in Asia. This trend not only enhances the efficiency of cross-border transactions but also signals a vibrant future for international commerce facilitated by these innovative financial instruments.